Table of Contents

- What is Customer Lifetime Value?

- The Difference Between CLV and LTV

- How to Calculate Customer Lifetime Value

- Why Is Customer Lifetime Value Important?

- Increasing Customer Acquisition

- Improving Customer Retention Rates

- Reducing Churn

- Better Resource Allocation

- Boosting ROI

- Effective Strategies for Businesses to Increase CLV

- Contextual Customer Segmentation

- Personalization

- Cross-Selling and Upselling

- Customer Retention Programs

- Open Communication

- Omnichannel Customer Experiences

- EVAM: Empowering Businesses to Enhance CLV

What is Customer Lifetime Value?

Generating Customer Lifetime Value (CLV), also known as Lifetime Value (LTV), is crucial for measuring the exact revenue a single customer will bring to a business throughout their relationship. It provides businesses with insights into their customers’ worth and helps them in planning and implementing strategies to retain their most valuable customers.

The Difference Between CLV and LTV

While Customer Lifetime Value and Lifetime Value are similar, there are slight differences in how businesses focus on their metrics. CLV refers to the revenue a customer generates during their relationship with the business. LTV focuses more broadly on the profitability of customers over time.

How to Calculate Customer Lifetime Value

Customer Lifetime Value can be calculated using a simple formula by businesses willing to retain long-term relationships with their customers:

CLV = Average Purchase Value × Average Purchase Frequency × Average Customer Lifespan

For example, consider the following numbers for a business:

Average Purchase Value: $50

Average Purchase Frequency: 12

Average Customer Lifespan: 3 years

Using the formula:

CLV = $50 × 12 × 3 = $1,800

This means that, on average, each customer generates $1,800 in revenue throughout their relationship with the business.

This data helps businesses evaluate their customers’ profitability and align their financial and operational decisions accordingly.

Why is Customer Lifetime Value Important?

Understanding and increasing Customer Lifetime Value allows businesses to focus on revenue and customer growth while improving relationship management. Here’s why it’s essential:

1. Increasing Customer Acquisition

CLV helps in identifying profitable customer segments, enabling businesses to invest more in acquiring high-value customers while reducing costs on less profitable ones.

2. Improving Customer Retention Rates

Calculating CLV can reveal important information regarding customers and their purchasing habits. Businesses can tailor their products and services to their customers’ needs by making informed decisions and developing loyalty programs, thereby improving retention rates.

3. Reducing Churn

By identifying patterns, studying CLV can show areas of weakness and enabling businesses to target at-risk behaviors. A focus on reducing churn creates a proactive approach to retaining valuable customers.

4. Better Resource Allocation

CLV can help businesses understand which customers are the most profitable and deserving of further investments while reducing costs on less profitable customers.

5. Boosting ROI

Businesses with strategies to improve CLV often see increased ROI as customers remain loyal, and the value derived from each customer grows over time.

Effective Strategies for Businesses to Increase CLV

There are several strategies businesses can implement to increase CLV:

1. Contextual Customer Segmentation

Divide customers into segments based on demographics, purchasing habits, and behaviors to create personalized marketing campaigns that engage and retain customers.

2. Personalization

Develop targeted campaigns based on customer data that address specific needs and preferences, ensuring relevancy and engagement.

3. Cross-Selling and Upselling

Offer related or complementary products to customers to increase average purchase value and engagement.

4. Customer Retention Programs

Design loyalty programs or offer discounts for repeat customers to encourage long-term relationships and consistent revenue streams.

5. Open Communication

Encourage regular feedback from customers to improve the relationship and keep them engaged with the brand.

6. Omnichannel Customer Experiences

Provide seamless transitions across different platforms and touchpoints, such as mobile apps, websites, and customer support channels, ensuring a consistent customer journey.

EVAM: Empowering Businesses to Enhance CLV

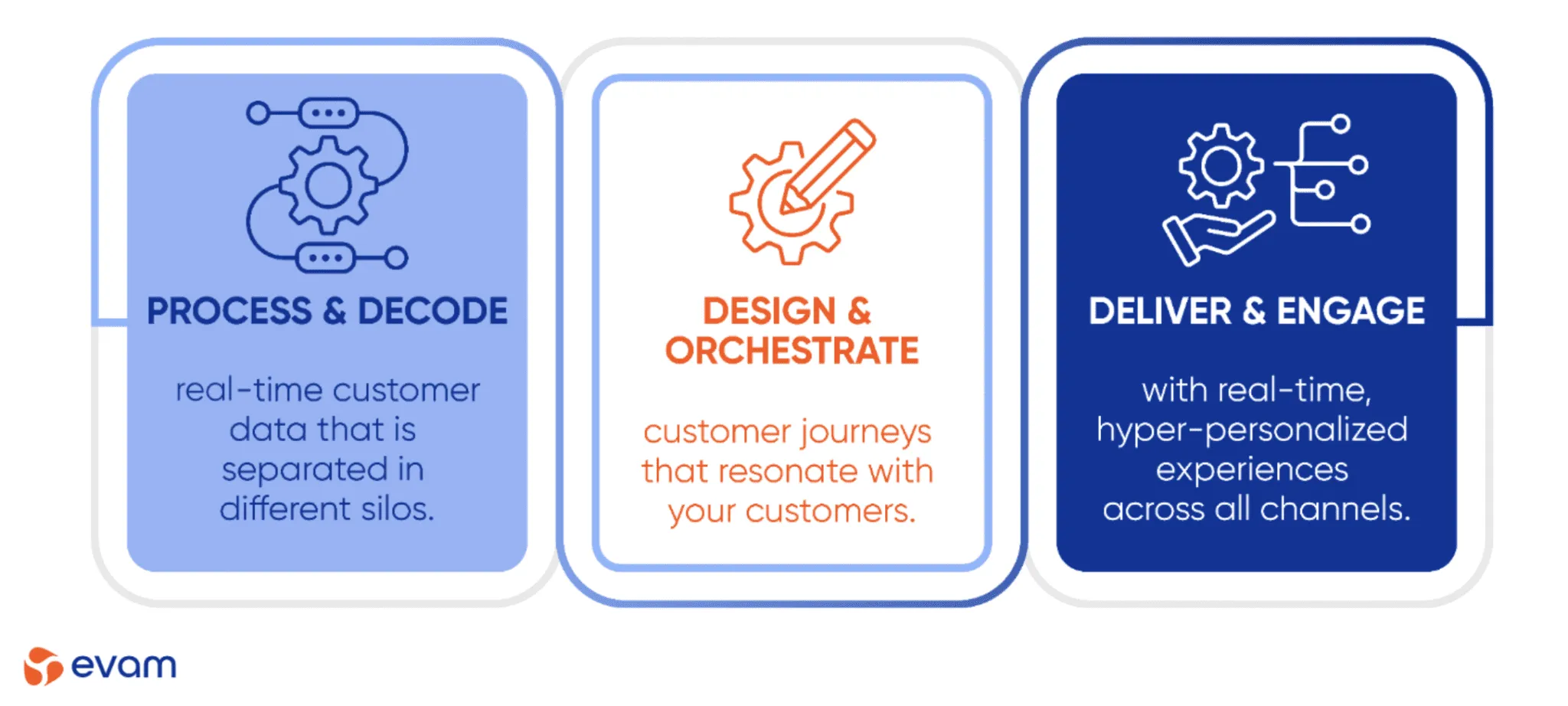

With advanced tools for segmentation, data analysis, and engagement, EVAM enables businesses to implement effective CLV strategies tailored to their unique customer base.

Are you ready to discover how EVAM can help your business improve customer engagement and boost customer lifetime value?